Masters' Level Real Estate Data Science Course

Course Overview

We are proud to offer one of the world’s first data science, machine learning, and GIS courses dedicated to analyzing, investing in and forecasting property globally.

Through a series of interactive online lectures, hands-on learning and the completion of a key capstone project, you will gain the knowledge and expertise to construct indexes, automate valuations, analyze clusters and forecast time series.

You will gain the necessary skills to utilize large datasets to determine fair transaction prices, forecast future returns and how to analyze locations with geographic information systems (GIS).

Course Modules

What will you learn

- Data Science Fundamentals (as applicable to all industries) including Python, Pandas, and Scikit-Learn;

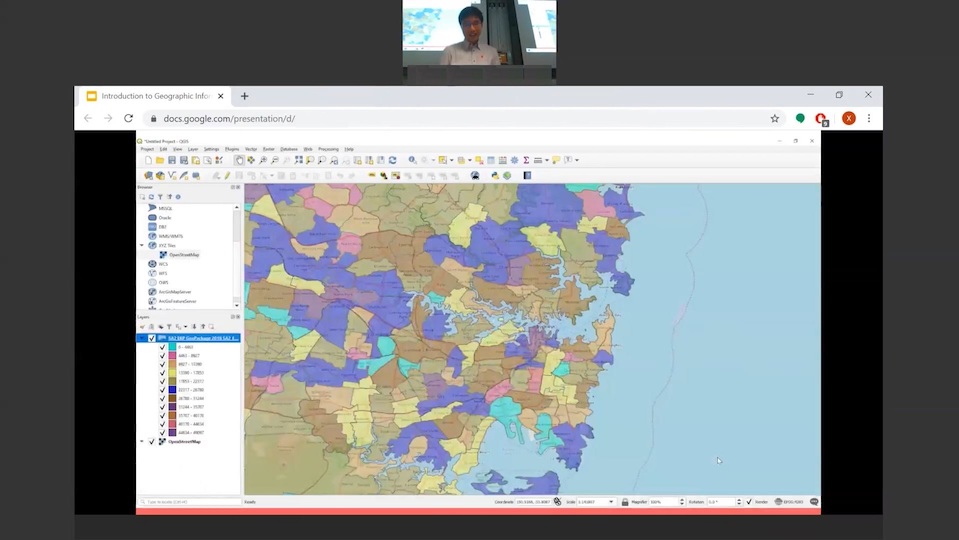

- Geographic Information Systems;

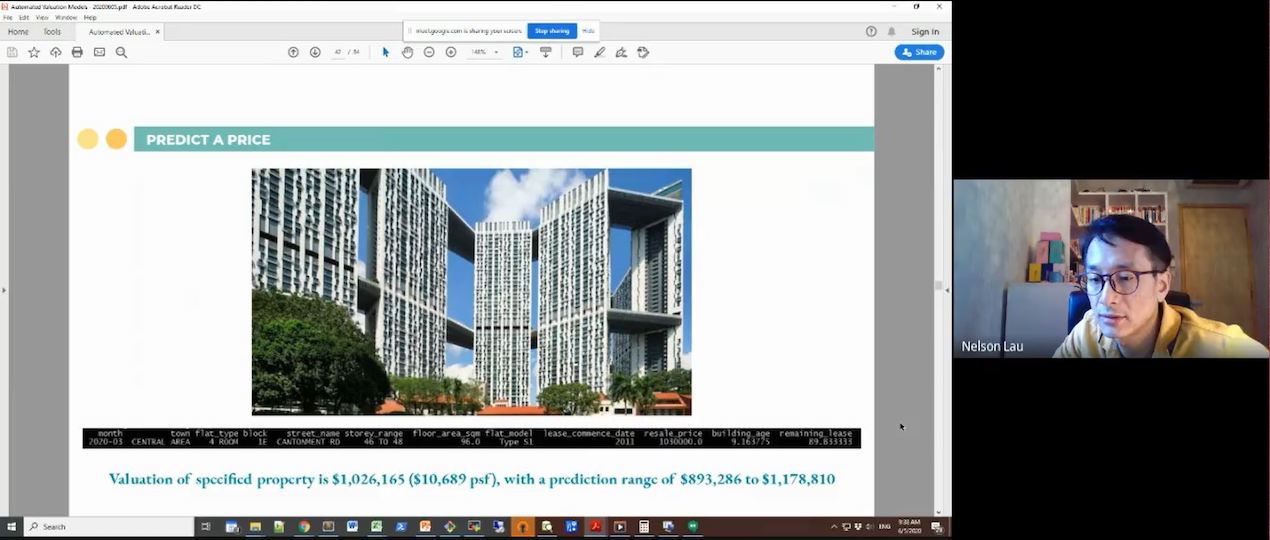

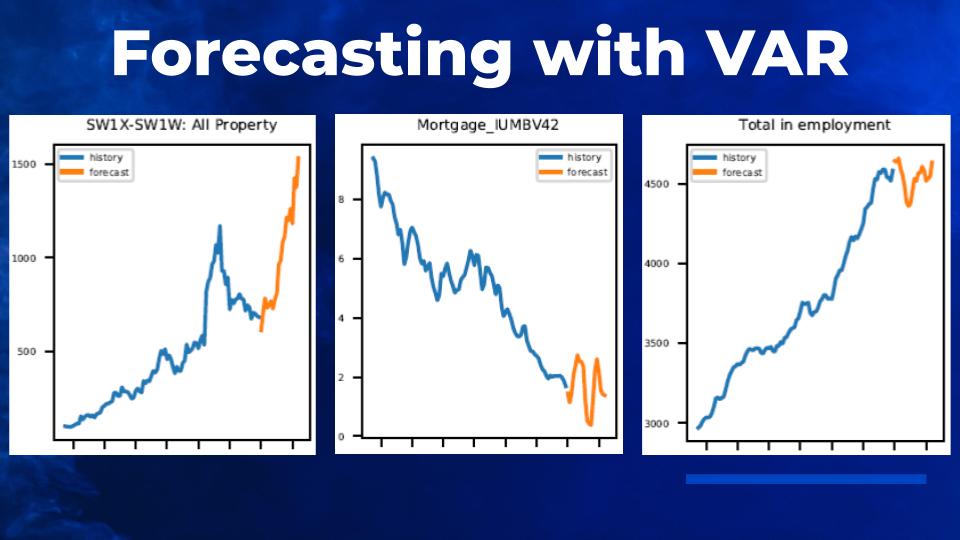

- Data Science Methods for Real Estate, including index construction, automated valuation, cluster analysis, and time series forecasting (ARIMA, VAR, and VECM).

- The ability to utilize large datasets to determine fair transaction prices and forecast future returns.

Course Segments & Time Commitment

The program is made up of three (3) main segments. Segments can be taken individually, pending your interest and level of expertise.

| Course Segments | Course Bundles | Modules | |||

|---|---|---|---|---|---|

| A | B | C | D | ||

| Bootcamp (20-30 hrs) |

B1,B2,B3 | ||||

| Real Estate Course (25-35 hrs) |

1,2,3,4,5,6,7 | ||||

| GIS Courses (6-8 hrs) |

G1,G2 | ||||

Classes consist of interactive, online video conferences. Office hours are one-on-one online video conferences. The capstone project is presented online – students are invited to (but not required to) attend the project presentations of their classmates.

Total Course Time Commitment: ~60 hours - 5 hours/week

Meet Your Instructors

Nelson Lau, PhD, CFA

Nelson is the CEO of PropertyQuants Pte. Ltd., a PropTech startup bringing quantitative methods to global real estate. He has a PhD in Decision Sciences from INSEAD, is a CFA Charterholder, and completed his undergraduate work at Columbia University, double majoring in Economics and Mathematics-Statistics. Nelson holds adjunct faculty instructor roles at the Singapore Management University and National University of Singapore's Asian Institute of Digital Finance.

He has published papers in Management Science, Decision Support Systems, and Decision Analysis, one of which received a special recognition award. Nelson started his career as a trader/researcher at R G Niederhoffer Capital Management, an award-winning US hedge fund deploying systematic data-driven medium and low frequency strategies to global markets, and also spent significant time as lead trader at KCG, a leading global high frequency algorithmic trading firm.

He was also a Quantitative Macro Strategist at GIC and Managing Director at a proprietary trading firm (Acceletrade Technologies). Nelson has been investing in international residential real estate in a personal capacity for 10 years, and has a deep interest in bringing more systematic, quantitative, and data-driven approaches to real estate practice.

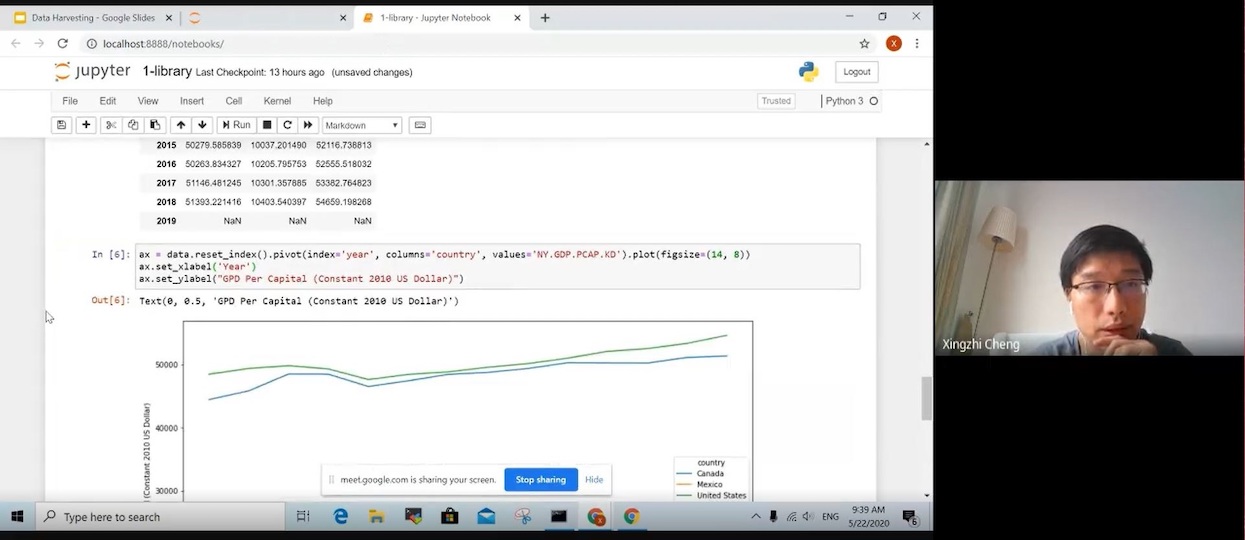

Xingzhi Cheng, PhD

Xingzhi is CTO of PropertyQuants and has a PhD in Statistical Physics from the National University of Singapore (NUS) and a B.S. in Computer Science from Peking University, with papers published in Physical Review Letters and elsewhere.

He was a postdoctoral research fellow at the Santa Fe Institute and NUS before moving to quantitative trading, where he has 5 years of experience as a researcher, trader, and quantitative developer.

Xingzhi enjoys architecting and developing software and frameworks for systematic and automated research. He’s also developed mobile apps and several different websites in his free time, one of which focused on tracking SGX-listed REITs, and another which analyzed which properties were best to buy or rent for parents in Singapore looking to maximize primary school admission priority for their children. He’s currently excited about building the PropertyQuants platform enabling quantitative and systematic approaches to be applied to real estate investing globally.

Who is this course for?

Participants with a basic foundation in mathematics / statistics at a high school level (GCE ‘A’ level, International Baccalaurate, or equivalent) or higher.

Participants without a background in Python, Pandas, and Sci-kit Learn are required to participate in the bootcamp prior to the course.

The topics we cover are novel and constitute an extension to typical data science courses. Experienced data scientists will gain significant value from participating in all sections of the program.

Complete the form below to recieve our full program brochure containing additional course information and pricing.

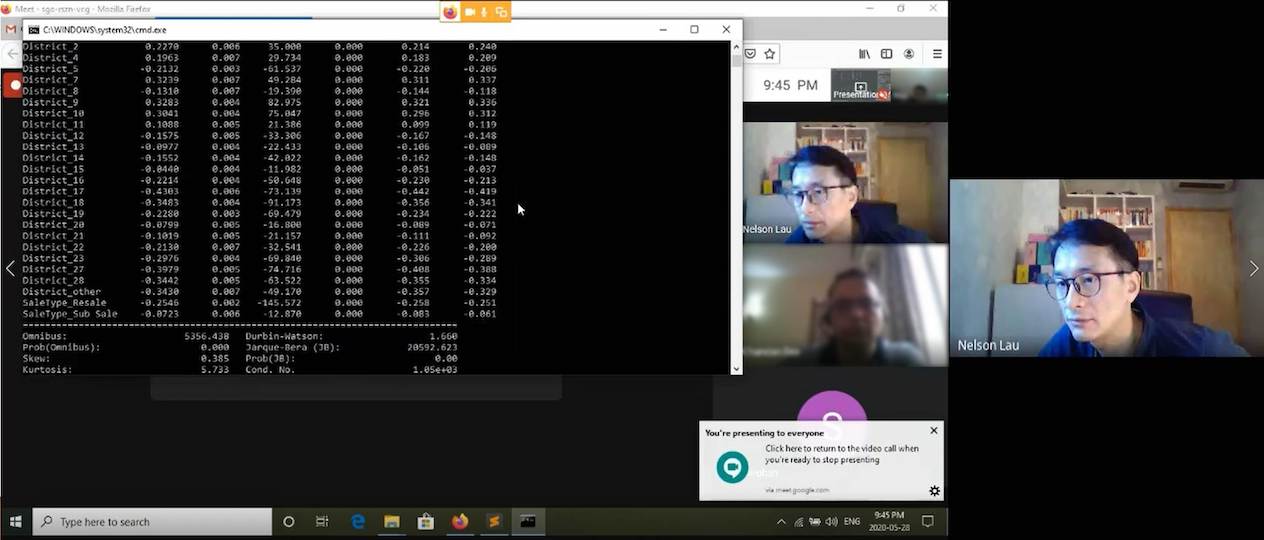

Course Screenshots

Video Clips

PropertyQuants Achievements

Certified FinTech: AI & Data Analytics Provider

Class of 2019, Colliers Techstars PropTech Accelerator

Grant Recipient, MAS FSTI POC Scheme

Shortlist, Innoleap Call for Solutions (CFS) 2019